Welcome to our latest article discussing the importance of streamlining business operations by integrating Customer Relationship Management (CRM) with accounting software. This powerful combination can help businesses improve efficiency, increase productivity, and enhance customer relationships. By seamlessly connecting these two essential tools, companies can gain valuable insights, automate processes, and ultimately drive growth. Join us as we explore the benefits and best practices of integrating CRM with accounting software.

Integrating CRM and Accounting Software for Seamless Operations

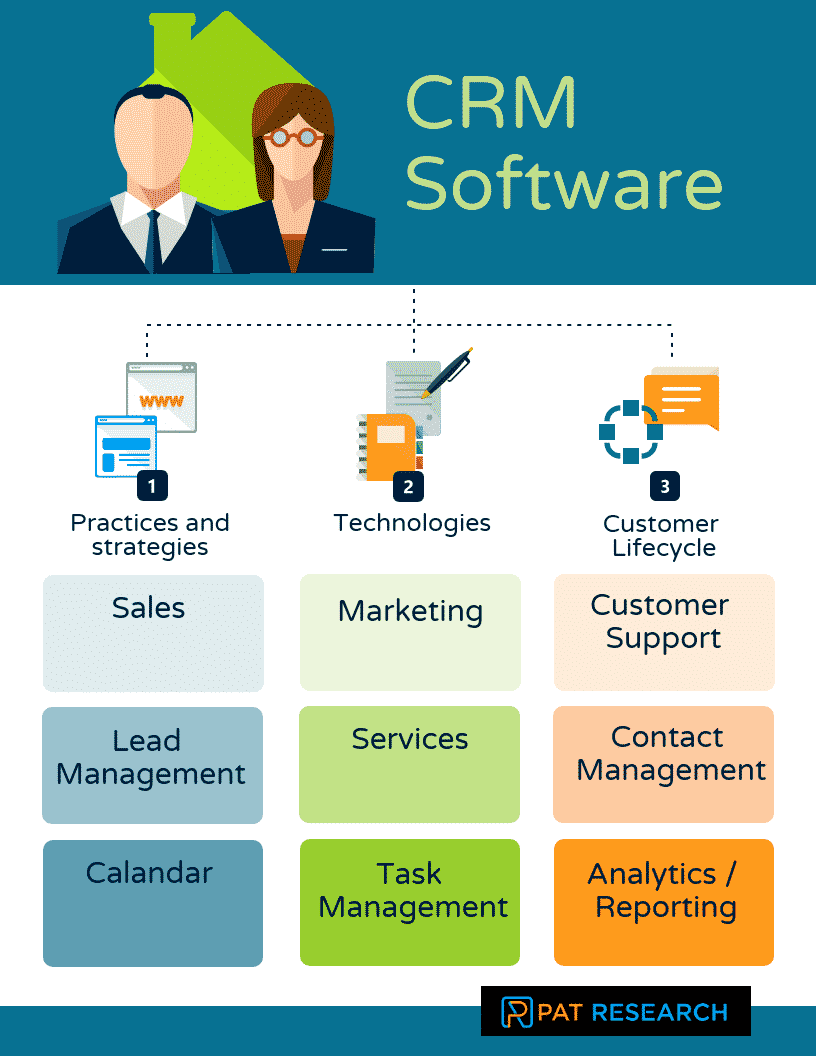

When it comes to running a business efficiently, integrating CRM and accounting software is crucial for seamless operations. CRM software helps businesses manage their relationships with customers, while accounting software is essential for keeping track of financial transactions. By combining these two systems, businesses can streamline their processes, improve communication between departments, and ultimately boost productivity and profits.

One of the main benefits of integrating CRM and accounting software is the ability to access all relevant customer and financial data in one place. This means that sales teams can easily see a customer’s purchasing history, outstanding invoices, and payment status, allowing them to provide better service and potentially upsell or cross-sell products. On the accounting side, having access to customer information can help ensure accurate billing and timely payments, reducing the risk of errors and late payments.

Another advantage of integrating CRM and accounting software is the automation of manual tasks. For example, when a sales team closes a deal in the CRM system, the corresponding invoice can be automatically generated in the accounting software, eliminating the need for manual data entry and minimizing the risk of errors. This streamlines the entire process from sales to billing, saving time and reducing the likelihood of discrepancies.

Furthermore, integrating CRM and accounting software can improve communication between departments. Sales teams can provide accounting departments with real-time updates on customer accounts, allowing for better coordination and collaboration. This can lead to faster responses to customer inquiries and more efficient problem-solving, ultimately enhancing customer satisfaction and loyalty.

Additionally, integrating CRM and accounting software can provide businesses with valuable insights into their operations. By analyzing data from both systems, businesses can identify trends, track performance metrics, and make informed decisions about sales strategies and financial management. This helps businesses stay ahead of the competition and adapt to changes in the market quickly and effectively.

In conclusion, integrating CRM and accounting software is essential for businesses looking to improve efficiency, streamline processes, and enhance customer relationships. By combining these two systems, businesses can access all relevant data in one place, automate manual tasks, improve communication between departments, and gain valuable insights into their operations. Ultimately, integrating CRM and accounting software can help businesses achieve seamless operations and drive success in today’s competitive marketplace.

Streamlining Customer Data Management with Accounting Software in CRM

Customer Relationship Management (CRM) software is an essential tool for businesses to efficiently manage and analyze customer interactions and data throughout the customer lifecycle. When integrated with accounting software, CRM becomes even more powerful by streamlining customer data management and providing a holistic view of customer relationships and financial transactions.

One of the key benefits of using accounting software in CRM is the ability to centralize customer data in one system. Instead of having customer information spread across different platforms and departments, businesses can consolidate all customer data in one place, making it easier to access, update, and analyze. This centralized approach ensures that all team members have access to up-to-date customer information, leading to better collaboration and communication within the organization.

Furthermore, accounting software in CRM allows businesses to track and manage customer financial transactions seamlessly. By integrating accounting data with customer information, businesses can gain insights into customer purchase history, payment status, and outstanding balances. This visibility enables businesses to identify opportunities for upselling and cross-selling, as well as proactively address any billing or payment issues with customers.

Another advantage of using accounting software in CRM is the ability to automate repetitive tasks and processes. For example, businesses can set up automated invoicing and payment reminders, reducing manual work and ensuring timely payments from customers. Automation also helps improve efficiency and accuracy in data entry and record-keeping, minimizing errors and discrepancies in customer data management.

Additionally, accounting software in CRM provides businesses with comprehensive reporting and analytics capabilities. By generating reports on customer financials, sales performance, and profitability, businesses can make data-driven decisions that drive growth and optimize customer relationships. These insights also help businesses forecast future revenue, identify trends, and assess the overall financial health of the organization.

Overall, integrating accounting software in CRM enhances customer data management by centralizing customer information, tracking financial transactions, automating processes, and providing valuable insights through reporting and analytics. By leveraging the combined power of CRM and accounting software, businesses can build stronger customer relationships, improve financial visibility, and drive operational efficiency for long-term success.

Enhancing Financial Insights through CRM and Accounting Software Integration

Integrating Customer Relationship Management (CRM) software with Accounting software can provide businesses with a comprehensive view of their financial data and customer interactions. This integration allows for seamless communication between sales, finance, and customer service departments, resulting in a better understanding of customer needs and preferences. By combining CRM and Accounting software, businesses can streamline processes, improve efficiency, and gain valuable insights into their financial health.

One of the key benefits of integrating CRM and Accounting software is the ability to track customer interactions and financial transactions in one central system. This allows businesses to easily access a complete history of customer communications, purchases, and payments, providing a holistic view of each customer’s relationship with the company. By having this information readily available, businesses can tailor their sales and marketing efforts to individual customer needs and preferences, ultimately leading to increased customer satisfaction and loyalty.

Furthermore, integrating CRM and Accounting software enables businesses to generate more accurate financial reports and forecasts. By combining customer data with financial data, businesses can gain valuable insights into their revenue streams, expenses, and profitability. This can help businesses make informed decisions about pricing, budgeting, and resource allocation, ultimately leading to improved financial performance.

Another advantage of CRM and Accounting software integration is the ability to automate repetitive tasks and streamline workflow processes. For example, businesses can automatically generate invoices, track payments, and send reminders for overdue payments, reducing the burden on finance teams and improving cash flow management. This automation not only saves time and resources but also minimizes the risk of human error, ensuring that financial data is accurate and up-to-date.

Additionally, integrating CRM and Accounting software can provide businesses with valuable insights into customer behavior and preferences. By analyzing customer data alongside financial data, businesses can identify patterns, trends, and opportunities for cross-selling and upselling. This information can help businesses personalize their marketing messages and offers, ultimately increasing sales and revenue.

In conclusion, integrating CRM and Accounting software can enhance financial insights and provide businesses with a more complete view of their operations. By combining customer data with financial data, businesses can streamline processes, improve efficiency, and gain valuable insights into their financial health. This integration not only benefits finance teams but also sales and customer service departments, ultimately leading to increased customer satisfaction and profitability.

Boosting Sales with Advanced Reporting in CRM with Accounting Software

Advanced reporting in CRM with accounting software can be a game-changer for businesses looking to boost their sales. By leveraging the power of data and analytics, companies can gain valuable insights into their customer base, sales trends, and performance metrics. This information allows sales teams to make more informed decisions, target the right customers, and ultimately increase revenue.

One of the key benefits of advanced reporting in CRM with accounting software is the ability to track and analyze sales data in real-time. This means that sales teams can quickly identify which strategies are working and which are not, allowing them to make adjustments on the fly. For example, if a particular marketing campaign is not driving the desired results, sales teams can pivot to a different approach before it’s too late.

Another advantage of advanced reporting is the ability to segment customers based on their behavior and preferences. By analyzing past purchase history, interactions with the company, and other relevant data points, sales teams can create targeted marketing campaigns that are more likely to resonate with specific customer segments. This personalized approach can lead to higher conversion rates and increased customer loyalty.

Furthermore, advanced reporting in CRM with accounting software can help businesses identify cross-selling and upselling opportunities. By analyzing customer data and purchase patterns, sales teams can suggest complementary products or services that are likely to appeal to existing customers. This not only increases sales revenue but also enhances the overall customer experience by providing relevant recommendations.

Additionally, advanced reporting can help businesses track the performance of individual sales reps and teams. By analyzing key performance indicators such as sales quotas, conversion rates, and average deal size, managers can identify top performers, areas for improvement, and training needs. This data-driven approach to sales management can lead to a more efficient and effective sales process.

In conclusion, advanced reporting in CRM with accounting software is a powerful tool for businesses looking to boost sales and improve performance. By leveraging data and analytics, companies can gain valuable insights, make data-driven decisions, and ultimately increase revenue. Whether it’s tracking sales data in real-time, segmenting customers, identifying cross-selling opportunities, or tracking sales rep performance, advanced reporting can provide a competitive edge in today’s fast-paced business environment.

Improving Customer Relationships with Real-time Financial Data in CRM

When it comes to managing customer relationships, having access to real-time financial data through CRM software can be a game-changer. By integrating accounting software with your CRM system, businesses can gain deeper insights into their customers’ financial behavior, leading to improved customer relationships and increased sales. Here are five ways in which real-time financial data can enhance CRM:

1. Personalized Customer Interactions: With real-time financial data at their fingertips, sales and customer service teams can tailor their interactions with customers based on their purchasing history, payment preferences, and credit information. This level of personalization can help build stronger relationships with customers, leading to increased loyalty and repeat business.

2. Forecasting Customer Needs: By analyzing real-time financial data, businesses can predict customer needs and preferences more accurately. For example, if a customer consistently purchases certain products at certain times of the year, the business can anticipate their future orders and have them ready in advance. This proactive approach can help businesses stay ahead of the competition and meet customer demands more effectively.

3. Identifying Upselling Opportunities: With access to real-time financial data, businesses can identify opportunities to upsell or cross-sell products and services to existing customers. For example, if a customer has a history of purchasing a particular product, the business can suggest complementary products or upgrades that may be of interest. By tailoring their offerings to customer preferences, businesses can increase revenue and deepen customer relationships.

4. Managing Payment Terms: Real-time financial data can help businesses track customer payment histories and outstanding balances more effectively. By monitoring customer credit limits and payment schedules, businesses can proactively address any issues before they escalate. This level of transparency and communication can help build trust with customers and reduce payment delays.

5. Improving Customer Satisfaction: One of the key benefits of integrating accounting software with CRM is the ability to provide real-time updates on order statuses, shipment tracking, and payment confirmations to customers. By keeping customers informed at every stage of the purchasing process, businesses can enhance customer satisfaction and loyalty. Additionally, businesses can use real-time financial data to resolve customer inquiries quickly and accurately, further strengthening the customer relationship.

In conclusion, integrating accounting software with CRM can significantly improve customer relationships by providing access to real-time financial data. By personalizing customer interactions, forecasting needs, identifying upselling opportunities, managing payment terms, and improving customer satisfaction, businesses can enhance customer loyalty, increase sales, and stay ahead of the competition. Overall, real-time financial data is a valuable asset for businesses looking to strengthen their customer relationships and drive growth.

Originally posted 2025-01-26 20:00:00.