Welcome to an insightful discussion on how small accounting firms can enhance their customer relationships through the effective use of CRM solutions. In today’s competitive business landscape, establishing and maintaining strong connections with clients is essential for long-term success. By utilizing CRM tools tailored to the unique needs of small accounting practices, firms can streamline operations, improve communication, and ultimately maximize client satisfaction. Let’s explore how CRM solutions can help small accounting firms build lasting relationships with their customers.

Overview of CRM for Small Accounting Firms

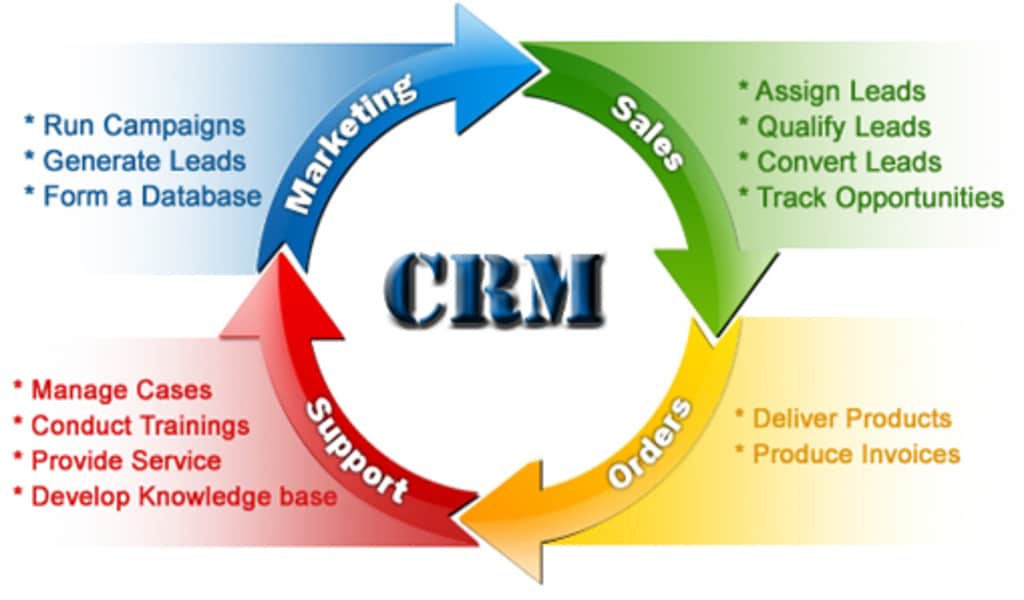

Customer Relationship Management (CRM) software is a valuable tool for small accounting firms looking to streamline their operations, improve client relationships, and increase overall efficiency. CRM systems allow firms to manage interactions with current and potential clients, track leads and opportunities, and analyze customer data to make data-driven decisions.

Having a CRM system in place can help small accounting firms effectively manage client information, improve customer service, and ultimately grow their business.

One of the key benefits of CRM software for small accounting firms is the ability to centralize client information. Instead of storing client data in multiple spreadsheets or separate systems, a CRM system allows firms to keep all client information in one place. This not only makes it easier to access and update client information but also provides a more holistic view of each client.

By having all client data in one place, accounting firms can better understand their clients’ needs, preferences, and history with the firm, allowing them to provide more personalized service and recommendations.

Additionally, CRM software can help small accounting firms improve client communication and engagement. By tracking client interactions, such as emails, phone calls, and meetings, firms can ensure that they are staying in touch with clients on a regular basis. CRM systems can also automate certain communication tasks, such as sending out regular updates or reminders, which can help firms stay top-of-mind with their clients and strengthen relationships over time.

Furthermore, CRM software can provide small accounting firms with valuable insights into their client base. By analyzing client data, firms can identify trends, spot opportunities for cross-selling or upselling, and make data-driven decisions about marketing and business development efforts.

This data-driven approach can help firms target the right clients with the right services, ultimately leading to increased revenue and profitability.

In conclusion, CRM software is a powerful tool for small accounting firms looking to improve client relationships, streamline operations, and drive growth. By centralizing client information, improving communication, and leveraging data insights, CRM systems can help small firms provide better service, attract new clients, and increase overall efficiency. As technology continues to evolve, CRM software will become an essential tool for small accounting firms looking to stay competitive in an increasingly digital world.

Benefits of Implementing CRM for Small Accounting Firms

Implementing a Customer Relationship Management (CRM) system can be incredibly beneficial for small accounting firms. A CRM system helps streamline operations, improve client relationships, and increase overall efficiency. Here are some of the key benefits of implementing CRM for small accounting firms:

1. Improved Client Relationships: One of the main benefits of CRM for small accounting firms is the ability to improve client relationships. With a CRM system in place, accounting firms can easily track client interactions, communications, and preferences. This allows firms to provide personalized service to clients, anticipate their needs, and ultimately build stronger, long-lasting relationships.

2. Enhanced Communication: CRM systems provide a centralized platform for storing client data, which can greatly enhance communication within the firm. With all client information easily accessible in one place, team members can collaborate more effectively, share important updates, and ensure that everyone is on the same page. This can lead to improved efficiency, better coordination, and ultimately, better service for clients.

3. Increased Efficiency: By implementing a CRM system, small accounting firms can streamline their operations and increase overall efficiency. With automated processes for tasks such as client onboarding, invoicing, and reporting, firms can save time and resources, allowing staff to focus on more value-added activities. This can help increase productivity, reduce errors, and ultimately improve the bottom line.

4. Better Data Management: CRM systems help small accounting firms better manage their data. By storing client information, communications, and interactions in one centralized system, firms can easily access, update, and analyze this data. This can lead to more informed decision-making, better insights into client needs, and ultimately, better service delivery.

5. Scalability: As small accounting firms grow, they need tools that can grow with them. CRM systems are scalable and can easily accommodate the needs of a growing firm. Whether it’s adding new users, integrating new functionalities, or expanding into new service areas, CRM systems can adapt to the changing needs of the firm, ensuring that it remains efficient and competitive.

Overall, implementing a CRM system can have a significant impact on the success of a small accounting firm. From improving client relationships to increasing efficiency and scalability, the benefits of CRM are clear. By investing in a CRM system, small accounting firms can position themselves for growth and success in an increasingly competitive market.

Choosing the Right CRM System for Your Small Accounting Firm

When it comes to choosing the right CRM system for your small accounting firm, there are several factors to consider. The first thing to think about is the size of your firm and the number of users who will be accessing the CRM system. Some CRM systems are better suited for larger firms with a high volume of clients, while others are designed for smaller firms with a more modest client base. It’s important to choose a CRM system that can scale with your firm as it grows, so you don’t have to switch systems later on.

Another important factor to consider is the features and functionality of the CRM system. Different CRM systems offer different capabilities, so it’s important to think about what your firm needs in terms of contact management, lead tracking, and reporting. Some CRM systems also offer additional features such as email marketing integration, client portals, and mobile access, so it’s worth considering whether these features are important to your firm.

It’s also important to consider the ease of use of the CRM system. Some systems are more user-friendly than others, so it’s important to choose a system that your team will be able to easily learn and use. Look for a system that offers a clean and intuitive interface, as well as good customer support and training resources. You want to make sure that your team is able to make the most of the CRM system without getting frustrated or overwhelmed.

Finally, it’s important to consider the cost of the CRM system. Different CRM systems have different pricing structures, so it’s important to choose a system that fits within your firm’s budget. Some CRM systems offer subscription-based pricing, while others charge a one-time fee for the software. It’s also worth considering any additional costs, such as implementation fees, customization fees, or training costs. Make sure to factor in the total cost of the CRM system when making your decision.

Strategies for Successful CRM Implementation in Small Accounting Firms

Implementing a Customer Relationship Management (CRM) system can greatly benefit small accounting firms by helping them manage client relationships, improve communication, and streamline processes. However, the key to a successful CRM implementation lies in carefully planning and executing strategies that are tailored to the specific needs of the firm.

Here are some strategies that small accounting firms can follow to ensure a successful CRM implementation:

1. **Identify the Goals and Objectives**: Before implementing a CRM system, it is important for small accounting firms to clearly define their goals and objectives. Whether the goal is to improve client communication, streamline workflow, or increase sales, having a clear understanding of what the firm hopes to achieve with CRM will help guide the implementation process.

2. **Choose the Right CRM Solution**: There are many CRM solutions available in the market, each offering different features and functionalities. Small accounting firms should carefully evaluate their options and choose a CRM solution that aligns with their specific needs and budget. It is important to consider factors such as ease of use, scalability, and integration capabilities when selecting a CRM solution.

3. **Train Employees**: The success of a CRM implementation largely depends on the willingness and ability of employees to use the system effectively. Small accounting firms should invest in training programs to ensure that employees are comfortable with the new technology and understand how to use it to its full potential. Providing ongoing support and guidance is also crucial to ensure long-term success.

4. **Customize the CRM System**: To maximize the benefits of a CRM system, small accounting firms should customize it to suit their unique requirements. This may involve tailoring the system to capture specific client information, setting up automated workflows, or integrating it with other software platforms used by the firm. By customizing the CRM system, small accounting firms can ensure that it meets their specific needs and helps them achieve their goals.

By following these strategies, small accounting firms can successfully implement a CRM system that will help them better manage client relationships, improve efficiency, and drive business growth. With careful planning and execution, a CRM system can be a valuable tool for small accounting firms looking to stay competitive in today’s fast-paced business environment.

CRM Best Practices for Small Accounting Firms

Customer Relationship Management (CRM) software is a valuable tool for small accounting firms looking to streamline their operations and improve client relationships. By implementing best practices for CRM, these firms can effectively manage customer data, drive business growth, and increase client satisfaction.

Here are five CRM best practices specifically tailored for small accounting firms:

1. Define Your CRM Objectives: Before implementing a CRM system, it’s important to clearly define your objectives. Identify what you want to achieve with the software, whether it’s improving client communication, increasing productivity, or tracking client interactions. By setting clear goals, you can tailor your CRM strategy to meet your specific needs.

2. Choose the Right CRM Software: There are many CRM software options available, so it’s important to choose one that aligns with your firm’s goals and budget. Look for a user-friendly platform that offers features such as contact management, lead tracking, and reporting capabilities. Consider cloud-based CRM solutions for easy access to client data anytime, anywhere.

3. Train Your Team: Effective CRM implementation requires proper training for all team members. Make sure your staff understands how to use the CRM software and its features. Provide ongoing training and support to ensure that everyone is comfortable using the system and maximizing its potential.

4. Centralize Client Data: One of the key benefits of CRM software is the ability to centralize all client data in one location. This allows your team to access important information quickly and easily, leading to improved efficiency and productivity. Make sure to regularly update and maintain client records to ensure accuracy.

5. Personalize Client Interactions: In addition to managing client data, CRM software can help small accounting firms personalize their client interactions. Use the software to track client preferences, communication history, and important dates. By sending personalized messages and offers, you can strengthen client relationships and foster loyalty.

By following these best practices, small accounting firms can leverage CRM software to enhance client relationships, streamline operations, and drive business growth. With the right CRM strategy in place, these firms can stay competitive in a fast-paced industry and deliver exceptional service to their clients.

Originally posted 2025-01-25 18:00:00.